Understanding the BendDAO Loan crisis

What is BendDAO?

BendDAO is a decentralized peer-to-pool based NFT liquidity protocol. NFT holders can instantly borrow ETH using their NFTs as collateral through the lending pool, while depositors provide ETH liquidity to earn interest.

The protocol provides a trustless liquidity solution to NFT holders who require ETH but do not wish to sell their NFTs. By depositing your NFT as collateral, the owner can borrow and repay ETH at any time. NFTs deposited will be placed in an NFT pool and converted into boundNFT.

How does it work?

Approved blue-chip collections are collateralized at 30%-40% of the floor price. This means that if you borrow ETH against your NFT at a floor price of 100E, BendDAO will provide you with a 40E loan (i.e. 40% FP of your NFT at the time of borrowing) with a 10-15% interest rate.

Health Factor and Liquidation:

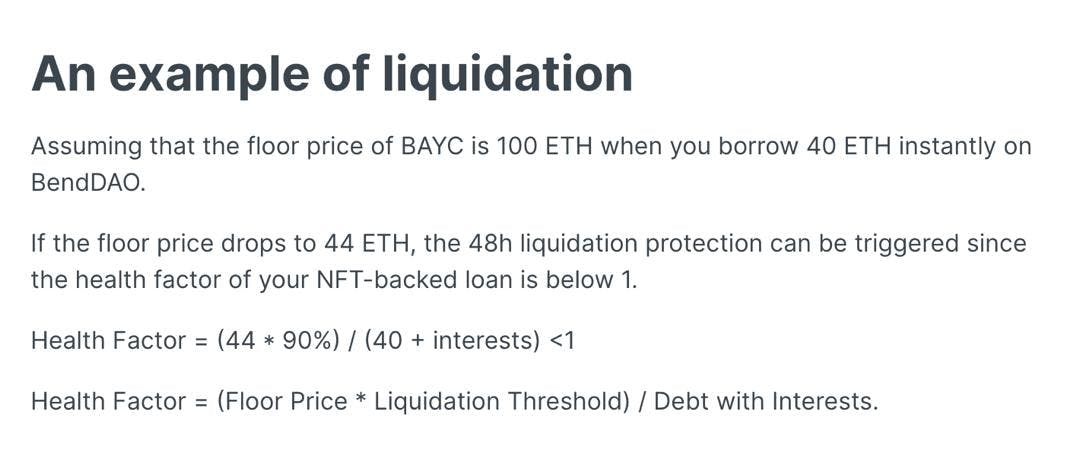

Liquidation is triggered when the NFT floor price falls below the liquidation threshold, resulting in a Health Factor of less than 1.0. When this happens, it automatically triggers a 48-hour liquidation protection window enabling borrowers to pay off the debt and reclaim their NFT. If the borrower fails to clear the debts + interest within 48 hours, the NFT is auctioned off to the highest bidder.

“The liquidation threshold is the maximum loan to value (LTV) which means debt plus interest to collateral value. If collateral has a liquidation threshold of 90%, the loan will be liquidated when the debt value is worth 90% of the collateral value. The liquidation threshold is specified per collateral and expressed in percentage points.” (Source: BendDAO).

Source: BendDAO

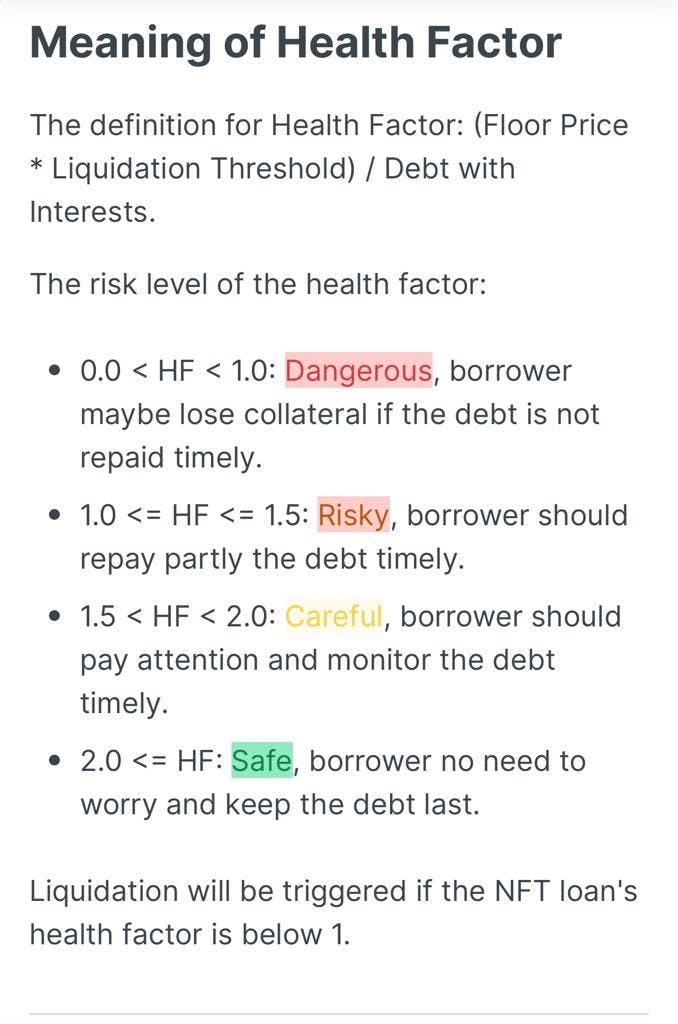

To keep your collateralized NFT from being liquidated Health Factor needs to be > 1.0

The HEALTH FACTOR is the numeric representation of the safety of your deposited NFT against the borrowed ETH and its underlying value. The higher the value is, the safer the state of your funds.

Health Factor (HF)= Floor Price X Liquidation threshold/Debt+Interest rate.

Source: (BendDAO)

Now that you have understood how the protocol works, how does it affect BAYC?

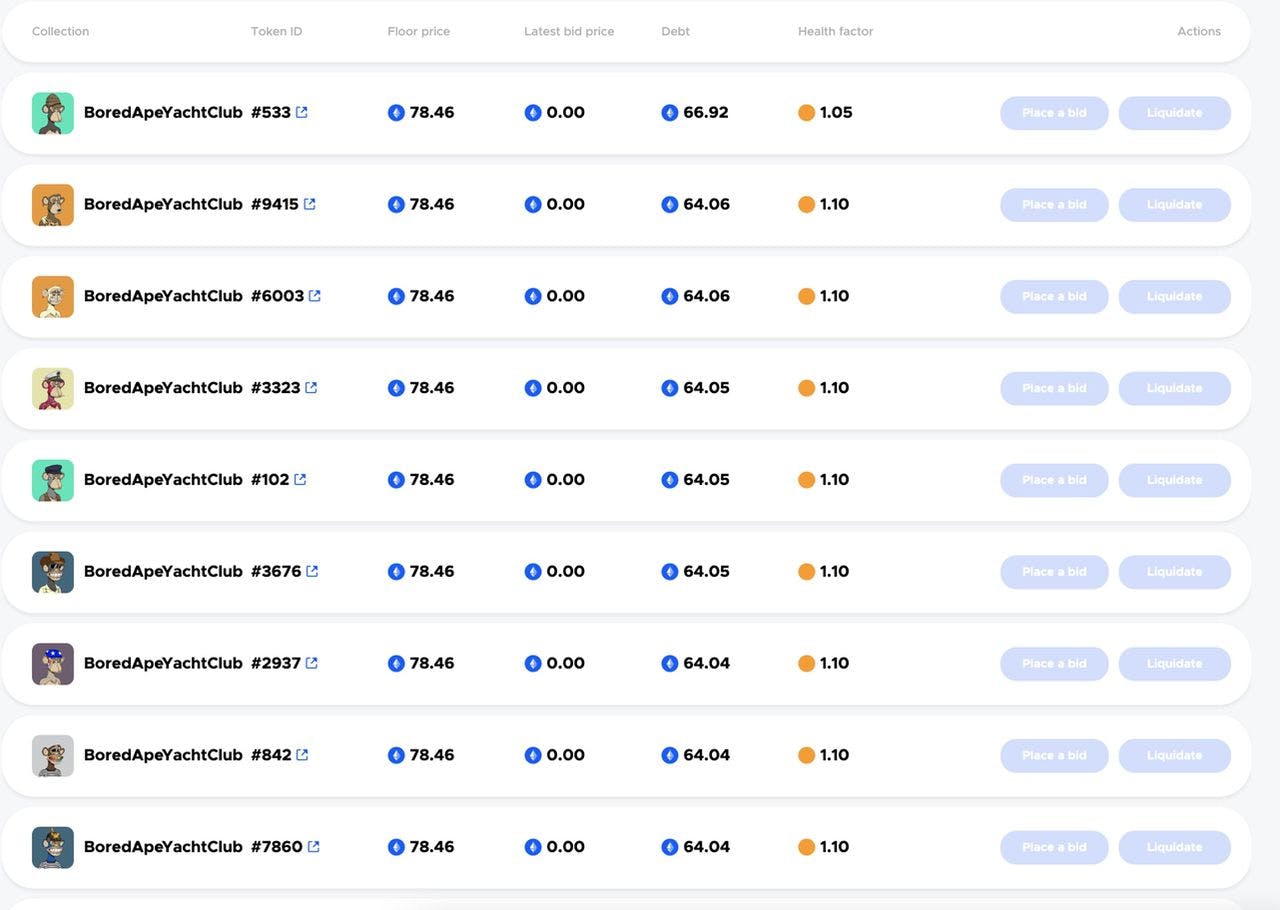

There is a large amount of BAYC-backed debts that are very close to falling below the 1 threshold as shown in the BendDAO health factor alert list:

Source: BendDAO HF Alert list

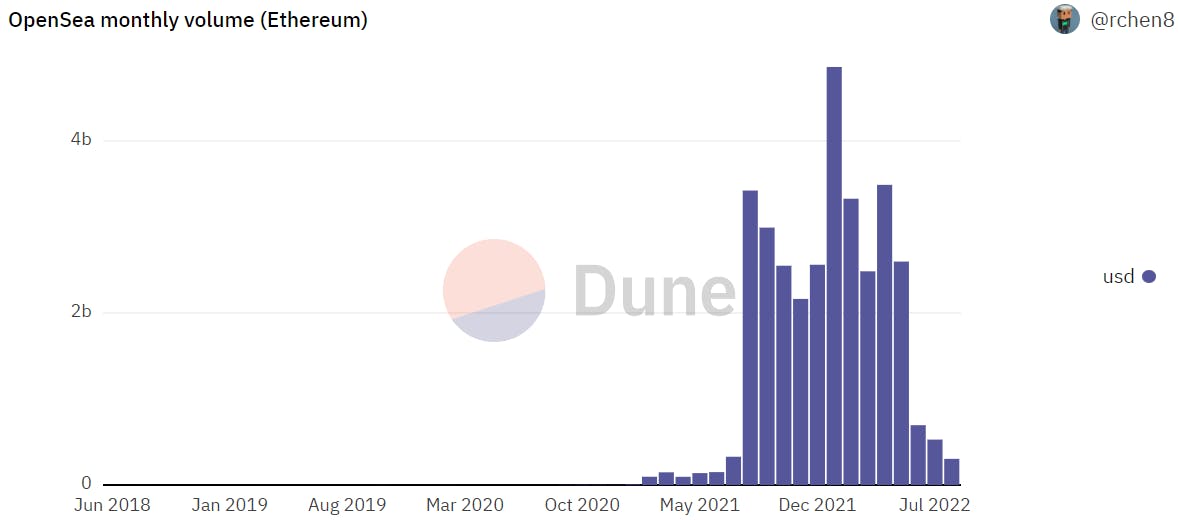

Given that NFTs trading volume is at a YoY low, there is growing concern that the current trading volume will be insufficient to absorb the liquidation, resulting in a cascading effect from these large liquidations.

Source: dune.com/rchen8/opensea

Facts & FUD:

According to research, most loans for BAYC-backed debts were obtained at around 125ETH floor price for BAYC and 30E floor price for MAYC. With BAYC liquidity down 13.3% compared to 0.5% of the previous week (NFTGo.io), things don't look good for the affected holders. The floor may continue to fall, resulting in panic selling and massive floor undercutting. The implication is that borrowers have no incentive to reclaim their NFT because it is currently worth less than their debt. So, unless the owner wants the NFT's specific IP, there is simply no reason to clear the debt.

The majority of the liquidated NFTs have no bids because the protocol requires bids to be at least 95% of the NFT collection's floor price and above the borrower's debt, leaving only a 5% upside for the bidder.

More profit potential= more bids.

Also to place a bid, you will be required to lock up ETH for 48Hrs, both of which do not incentivize traders.

The protocol's Liquidation bid requirements were also poorly designed, failing to account for VOLATILITY and the fact that the OpenSea floor is typically 5% higher than the global floor.

Not only are there few bids, but the debt positioned against the NTF is rising rapidly, potentially leading to the accumulation of "bad debts." BendDAO would have to QUICKLY find Market Makers who would buy the NFTs at a discounted price and/or change their terms, such as lowering the Liquidation threshold, to incentivize more bids to avoid the accumulation of these bad debts.

BendDAO’s Reaction:

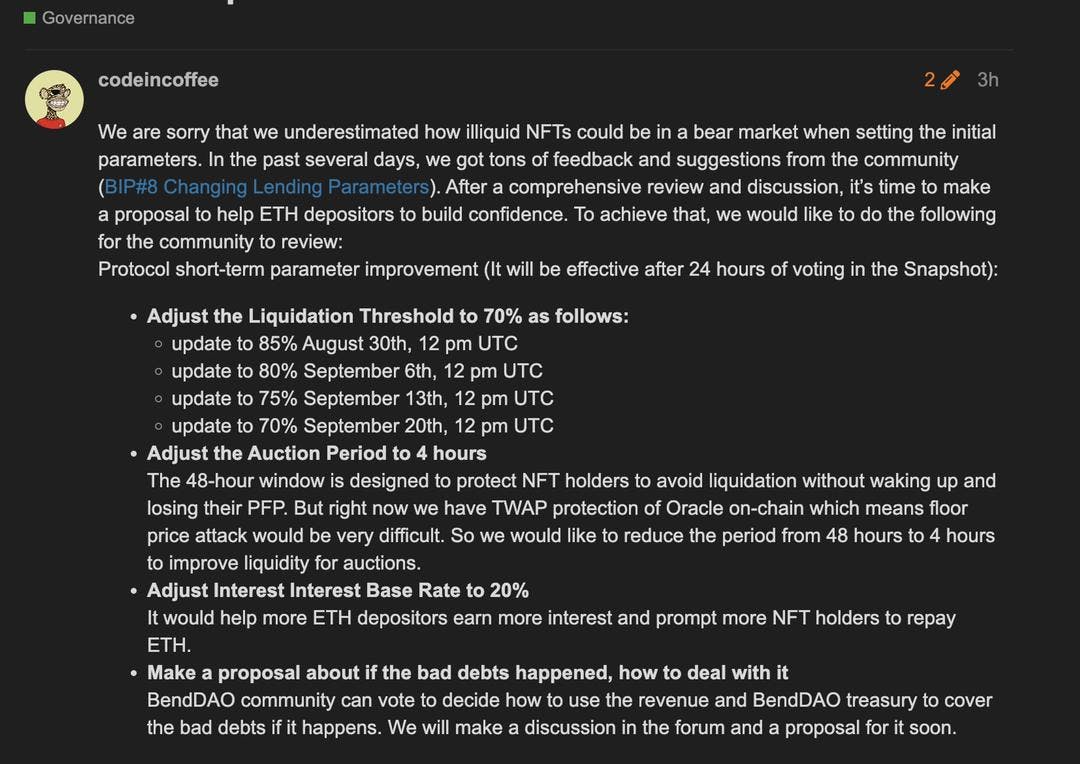

In response to the liquidation crisis, BendDAO's founder called for an emergency change to the protocol, proposing the following modifications:

- Adjust Liquidation Threshold to 70%

- Adjust the Auction window from 48 hours to 4H

- Adjust the interest rate baseline to 20%

Source: BendDAO

Takeaway:

- Illiquid assets like NFTs may not be suitable collateral for loans.

- Contrary to the initial understanding, the ratio of the BAYC/MAYC-backed loans to the total supply is relatively low to elicit a huge liquidity shock.

- This is an opportunity to buy these NFs at a discounted rate considering the ATH floor price.